Straight line depreciation formula maths

If possible please try your best and aim to be entered for the N5 Maths course in 3rd year. Arithmetic progression is used in real life for analyzing patterns like straight-line depreciation.

Qt 92 Formulas On Appreciation And Depreciation Youtube

An asset based upon its useful life will function in the organisation.

. Depreciation occurs when an item loses value over time. Fixed Installment or Equal Installment or Original Cost or Straight line Method. Several methods are used to determine depreciation.

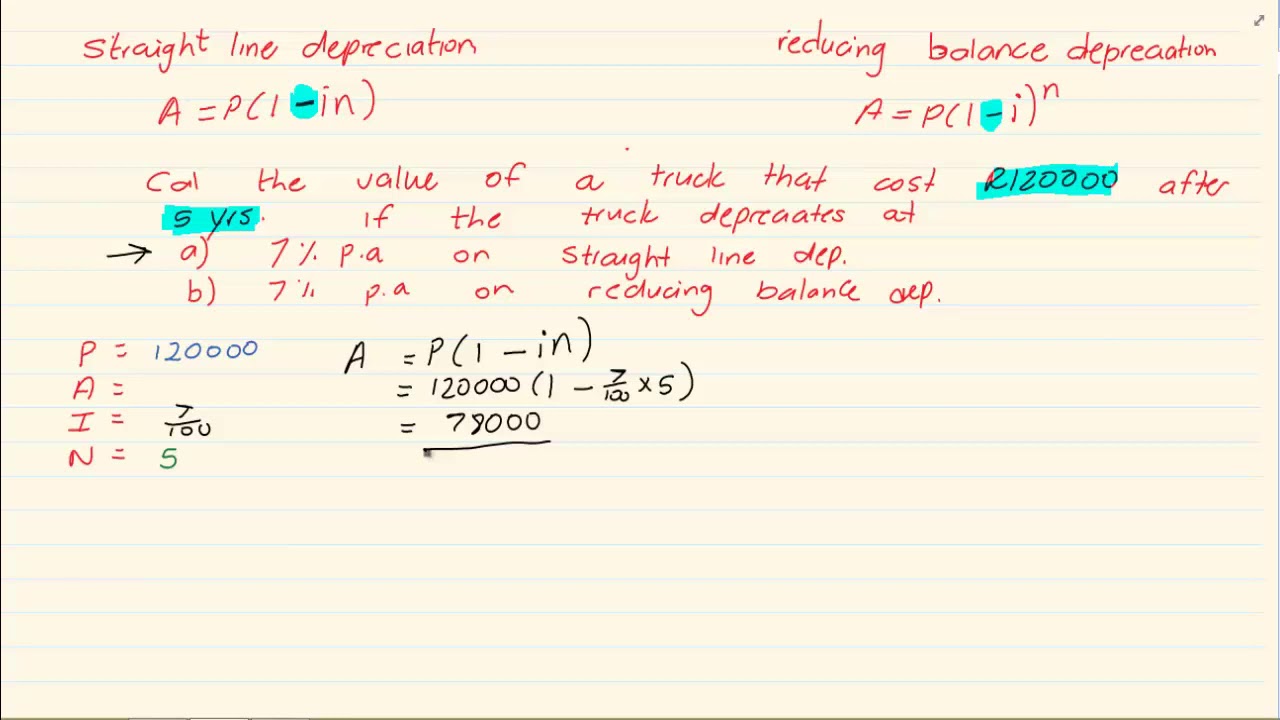

The amount of depreciation in the straight-line method remains the same every year. Appreciation Depreciation Theory Guide. Hence it is known as the Straight line method SLM.

These papers are also written according to your lecturers instructions and thus minimizing any chances of plagiarism. NCERT Solutions For Class 12 Maths. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

If you are a parent you may. Get 247 customer support help when you place a homework help service order with us. Mid-point of a line segment.

Equation of a line in the form y - y 1 mx - x 1 Distance between two points. D is the depreciated value. Rate of Depreciation 100 X Book Value.

The following resources are ideal for your GCSE Maths Revision. This method is more suitable in case of leases and where the useful life and the residual value of the asset can be calculated accurately. R is the rate of depreciation as a fraction or decimal per time period.

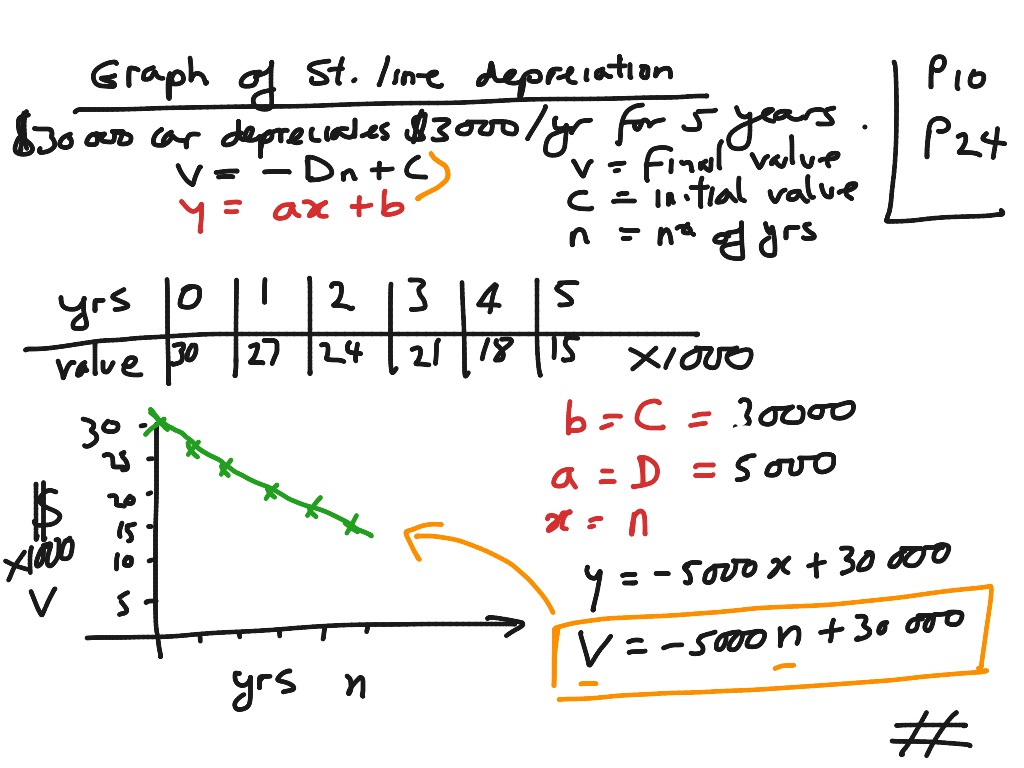

Dot Box Plots. Ending Investment Start Amount 1 Interest Rate n. When the amount of depreciation and the corresponding period are plotted on a graph it results in a straight line.

Operating Cash Flow Formula. You can use this as your GCSE Maths revision checklist too. The resources will provide excellent preparation for Maths in 3rd and 4th year.

Solving a quadratic equation using the. It is another method that provides a greater depreciation rate of 150 more than the straight-line method and then changes to the SLD amount when that method provides an equal or greater deduction. Anything with a next to it represents content that is brand new to GCSE Maths for the 2017 exams.

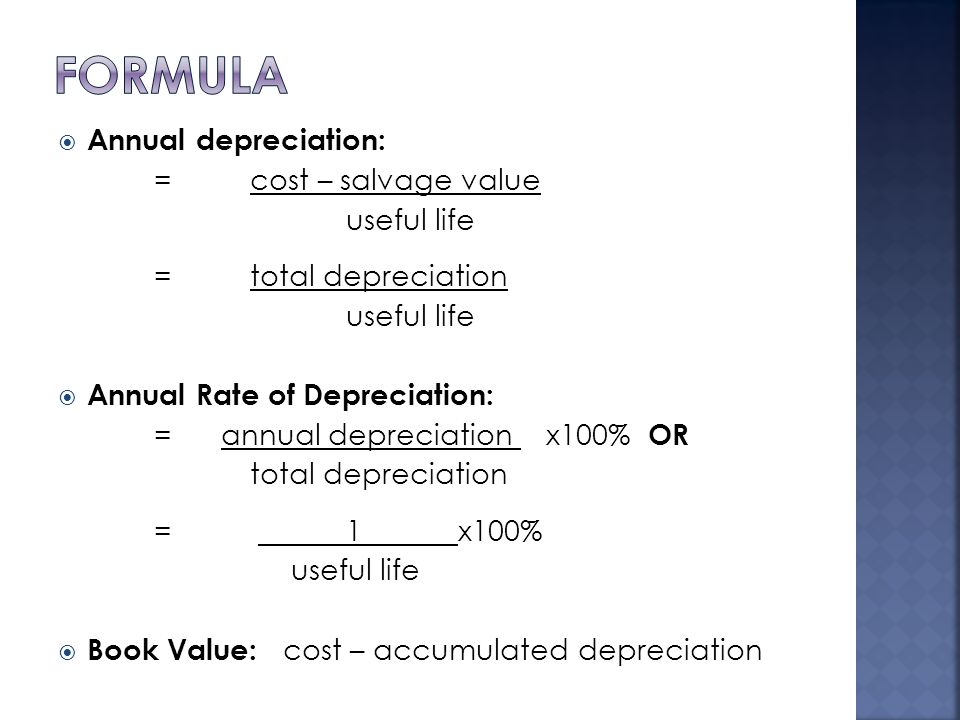

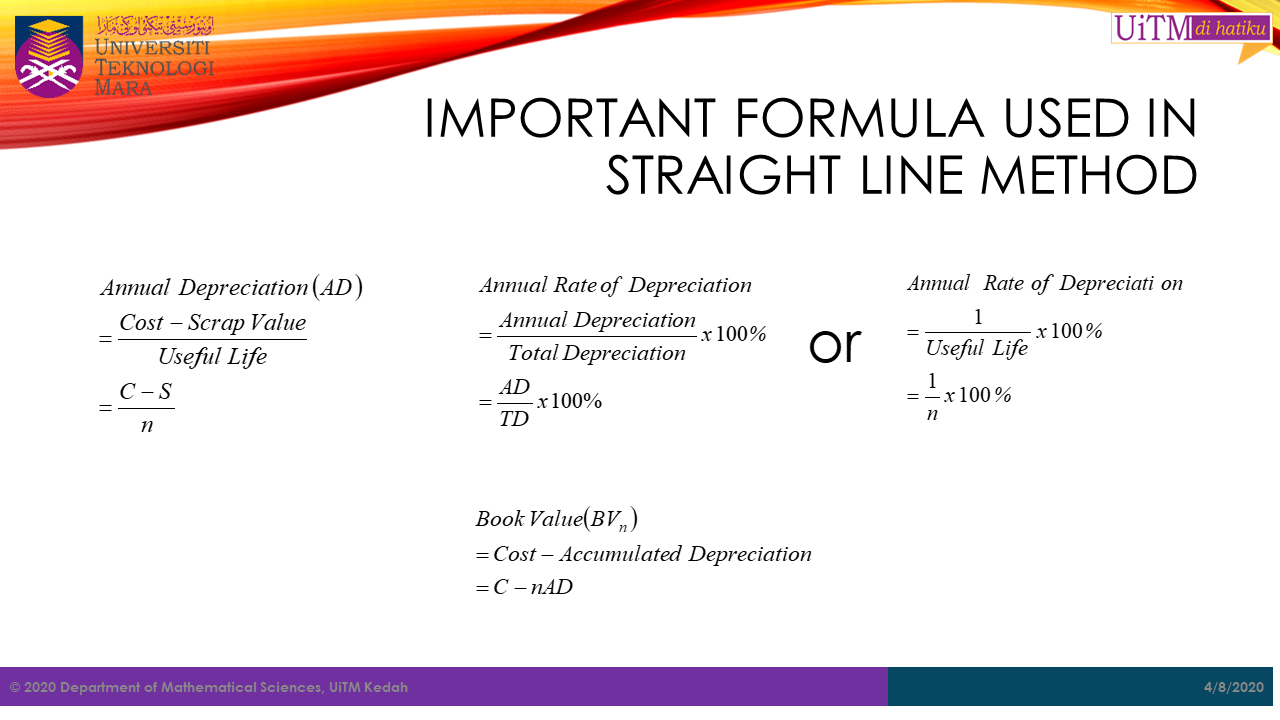

Hyperbola and straight line. Depreciation fracCost of asset Residual valueUseful life. Methods of Calculating Depreciation.

NCERT Solutions Class 12 Accountancy. The types of depreciation calculation owing to its methods are indicated below. Straight Line Method SLM ii.

Graphs Gradient of a straight line graph. Fixed assets undergo depreciation with time in accounting. All our academic papers are written from scratch.

Determining the equation of a straight line. Arithmetic progression is a series where a constant difference is maintained between any two consecutive numbers. GCSE Maths topics list by grade 9-1 and tiers Foundation and Higher.

Exam 2 is short answer. However where the repairs are low in. All our clients are privileged to have all their academic papers written from scratch.

Equation of a line in the form ymx c. Ajay Kumar May 7 2020 at 106 pm. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Since the straight line method utilizes the original cost or the acquiring cost in order to determine the salvage value of any asset in a competitive market the depreciation value of that asset is equal to the difference between the two. It is also used in prediction like If someone is waiting for a cab and traffic moving at a constant speed. N is the number of time periods.

Where n Number of years of investment. Parabola and a straight line. The amount of annual depreciation is computed on Original Cost and.

Ratio Write as a ratio. Solutions to past VCAA exam questions can be looked up in the appropriate examiners report on the Further Mathematics Past Examinations and Examination Reports page or the Northern Hemisphere Timetable NHT Past Examinations and Examination Reports pageExam 1 is multiple choice. The amount of depreciation in the diminishing balance method decreases.

So the formula for an ending investment is. Type in the grade or the topic you are searching for in the search box. Ratio proportion and rates of change see Number some overlap of topic areas.

Equation of a parallel line. Simply account the macrs straight line depreciation calculator to calculate macrs. Class 11 Commerce Syllabus.

This formula is applicable if the investment is compounded annually which means that we are reinvesting the money annually. A formula sheet will be provided for foundation tier and higher tier students. Cost of the Asset - Residual Value Useful life of the Asset.

National 5 Maths learning resources for adults children parents and teachers organised by topic. คาเสอมราคา หรอ Depreciation คอ คาใชจายทหกลบออกจากมลคาของสนทรพยทกจการใชประโยชนประจำงวดบญช ซงเจาคา. Straight Line Method SLM Under the depreciation Straight Line Method a fixed depreciation amount is charged annually during the lifetime of an asset.

The free maths websites are courtesy of Inigo Media the SQA and all the authors who have kindly made their resources freely available. After that period it must be scrapped or sold. Written down value method formula.

Doing well in Maths in S1 and S2 is important especially the end of year tests where pupils are usually streamed according to their test score. The depreciation formula is. The straight-line method of depreciation formula.

Here is a suggestion for how you might use these resources. Generally the investment interest rate is quoted per annum basis. Written Down Value Method WDV.

D P1 r n. In case of straight-line depreciation calculation the amount of expense is the same for each year of the asset lifespan. Of the methods straight line method is the most popular method.

A sequence is called an arithmetic progression if the difference between a term and the previous term is always the same. P is the principal. RD Sharma Solutions Class 11 Maths Chapter 19 Free PDF Download Updated for 2022-23 RD Sharma Solutions for Class 11 Maths Chapter 19 Arithmetic Progressions are provided here for students to study and prepare for their board exams.

Choose a topic you think you need to practice. If you are targetting a certain grade in your GCSE Maths exam then you can search the grade then copy the topics over to your preferred document. Straight Line Method SLM Over a GDS Recovery Period.

Equation of a perpendicular bisector. Under this method we deduct a fixed amount every year from the original cost of the asset and charge it to the profit and loss Ac. Whereas the form of declining balance depreciation involves the rate at which the value of the asset gets depreciated with time in the.

Gt10103 Business Mathematics Ppt Download

Grade 11 Financial Maths Depreciation Youtube

What Is The Straight Line Depreciation Formula How To Calculate Straight Line Depreciation Video Lesson Transcript Study Com

Depreciation Formula Calculate Depreciation Expense

Math Sc Uitm Kedah Depreciation

Straight Line Depreciation Youtube

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Find A Formula For A Function Modeling Linear Depreciation Solve A Linear Equation Youtube

Annual Depreciation Of A New Car Find The Future Value Youtube

What Is The Straight Line Depreciation Formula How To Calculate Straight Line Depreciation Video Lesson Transcript Study Com

Straight Line Depreciation Graph Math Finance Flat Rate Depreciation Economics Showme

Declining Balance Method Of Depreciation Formula Depreciation Guru

1 Press Ctrl A C G Dear 2009 Not To Be Sold Free To Use Straight Line Depreciation Stage 6 Year 12 General Mathematics Hsc Ppt Download

Straight Line Depreciation Youtube

Method To Get Straight Line Depreciation Formula Bench Accounting

2

1 Free Straight Line Depreciation Calculator Embroker